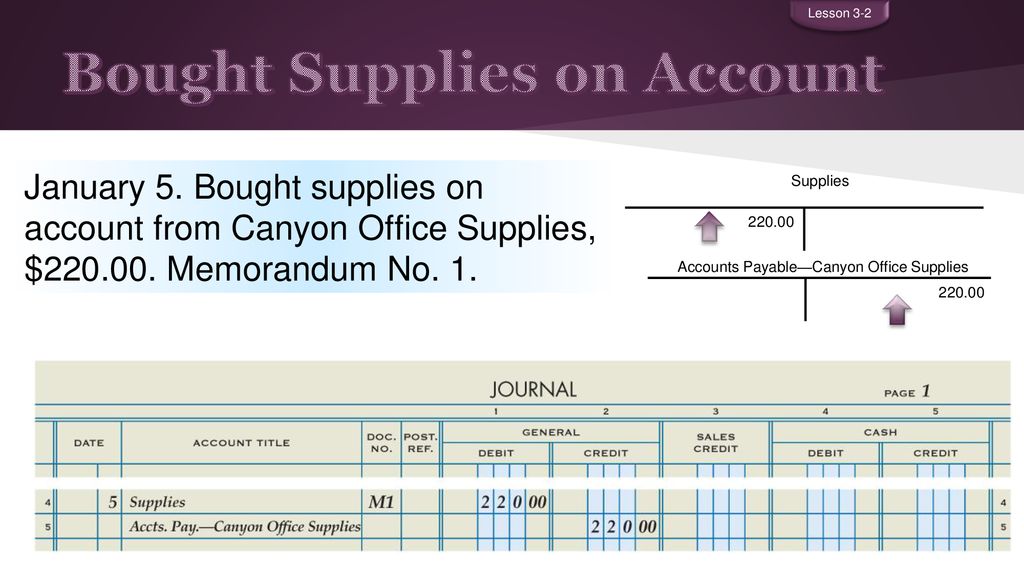

The accounting records will show the following purchased supplies on account journal entry. Debit Supplies and credit Accounts PayableJones Supply Company C.

Purchase Office Supplies On Account Double Entry Bookkeeping

200 Purchase supplies on account journal entryMerchandising.

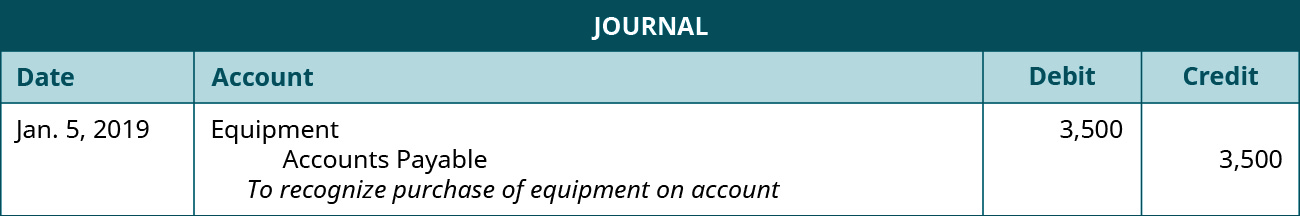

. View the full answer Transcribed image text. Recording a New Fixed Asset How to Journalize Basic Transactions and Adjusting Entries Accounting Principles Partnership Comp Prob Supplies Purchase - 40 Journal Entry Supplies Purchase on Account Journal Entry for Cost of Goods Sold INVENTORY u0026 COST OF GOODS SOLD T Accounts. This journal entry would be.

Purchase Depreciation Disposal 1. Company ABC purchased Office supplies on account costing 2500. In this case the company ABC can make the journal entry for the paid cash for supplies on March 18 2021 as below.

Q1 The entity purchased new equipment and paid 150000 in cash. The creditors account or account payable account will be credited in the books of accounts of the company. Nothing to record c.

Later on March 26 2021 it makes the payments of 3000 to settle the credit purchase of supplies on March 19 2021. Credit Account Payable e. Purchased 500 in supplies on account.

The journal entry to record this transaction is. Purchase Of Office Supplies Journal Entry. Debit Accounts PayableSteinman Company and credit Supplies debit Supplies and credit Accounts PayableSteinman Company debit Supplies and credit Cash Question 6 30 seconds Q.

Supplies Recording Transactions into a Purchases Journal Accounting for Beginners 57 Purchase Supplies on Account. Prepare a journal entry to record this transaction. Journal Entry DebitCredit Equipment 150000 n.

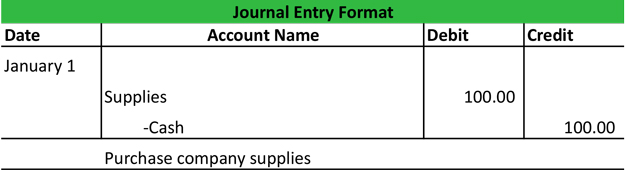

Make a journal entry on 1 January 2016 when the office supplies are purchased Make an adjusting entry on 31 December 2016 to record the supplies expense Solution 1. BuyerSeller Journal Entries 521Accounts XI - Journal entries - Purchase and purchase return Adjusting Entry Example. Debit Supplies and credit Cash.

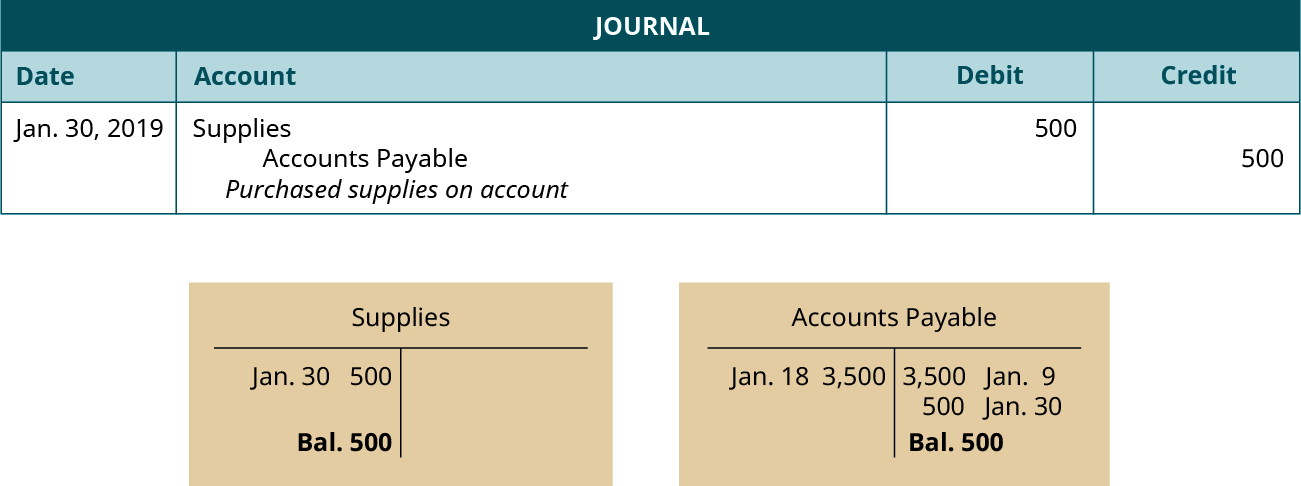

We analyzed this transaction as increasing the asset Supplies and the liability Accounts Payable. Answer choices debit Accounts PayableSteinman Company and credit Cash. Someone please please help.

The normal accounting for supplies is to charge them to expense when they are purchased using this entry. And credit the account you pay for the asset from. The company purchased 900 of supplies on account.

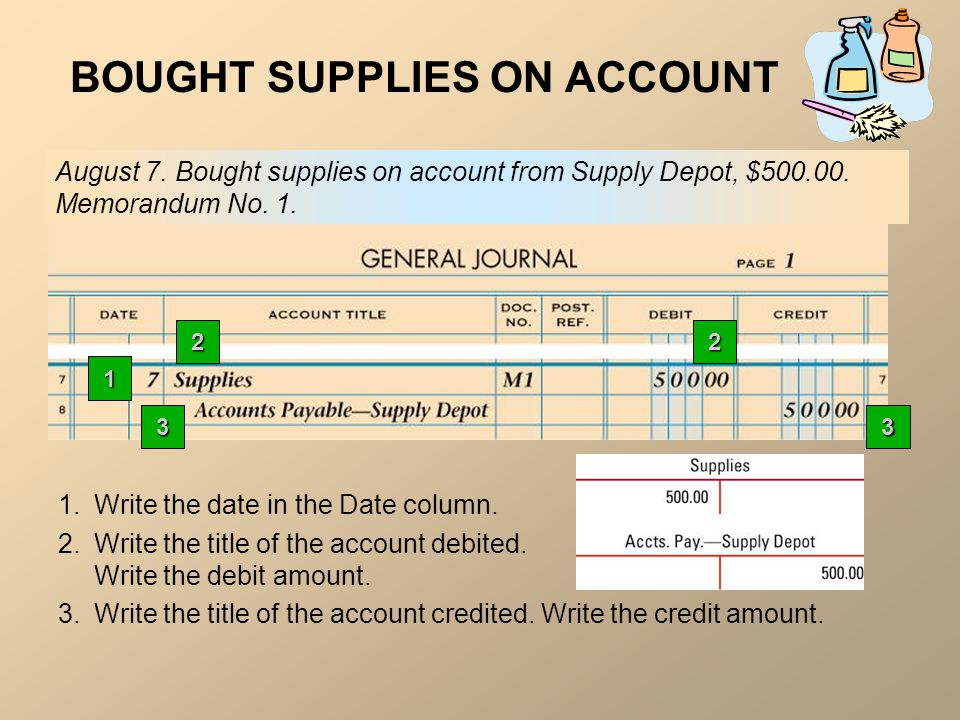

Which Journal entry records the payment on account of those office supplies. The correct journal entry for the transaction BOUGHT SUPPLIES ON ACCOUNT FROM STEINMAN COMPANY is. When supplies are purchased 2.

November 04 2021 Supplies are incidental items that are expected to be consumed in the near future. Supplies 185000 Accounts Payable Supply Company 185000 Second to record the return of supplies Accounts Payable Supply Company 20000 Supplies 20000 Third to record the cash payment on the credit purchase of supplies Accounts Payable Supply Company 165000 Cash 165000 Thomas Graham iii CPA CFE Oklahoma 7 yrs experience. Asset purchase When you first purchase new equipment you need to debit the specific equipment ie asset account.

Purchased supplies 750 on account. Purchase Credit Journal Entry is the journal entry passed by the company in the purchase journal of the date when the company purchases any inventory from the third party on the terms of credit where the purchases account will be debited. The purchase of supplies for cash is recorded in the accounting records with the following bookkeeping journal entry.

All Topics Topic Business Careers Accounting Journal Entry - Supplies bought on credit Heaven7401 Posts. Debit Accounts PayableJones Supply Company and credit Cash B. During the period it.

Bookkeeping Explained Debit The business has received consumable office supplies pens stationery etc and holds these as a current asset as supplies on hand. Debit Cash and credit Supplies. When cost of supplies used is recorded as supplies expense Supplies expense for the period 500 150 350 About the Author True Tamplin BSc CEPF.

Accounting questions and answers. Debit Supplies Expense and credit Accounts Payable. Credit Supplies O b.

Debit Supplies and credit Cash. Purchase Office Supplies on Account Double Entry Bookkeeping Journal Entry For Purchasing Supplies Journal Entry for Credit Purchase and Cash Purchase To run successful operations a business needs to purchase raw material and manage its stock. For Purchasing Supplies On AccountJournal Entry Quickbooks.

Company ABC plan to pay the 2500 at a later date. To increase an asset we debit and to increase a liability use credit. Office supplies used example For example the company ABC has office supplies of 1000 at the beginning of the period.

Debit Account PayableJones Supply Company and credit Supplies D. Expert Answer 100 14 ratings Since the purchases are made on credit the first general entry would be Date General Journal Ref Debit Cred. What is correct Journal entry.

Bookkeeping Explained Debit The business has received consumable supplies paper towels cleaning products etc and holds these as a current asset as supplies on hand. Paid 300 for supplies previously purchased. Debit Accounts Payable and credit Supplies.

Purchased supplies 750 on account. Keep this key piece of information in mind as we cover journal entries for the assets. Example 2 On March 19 2021 the company ABC make another purchase of supplies amounting to 3000 on credit.

What is the correct journal entry for the transaction BOUGHT SUPPLIES ON ACCOUNT FROM JONES SUPPLY COMPANY 250. Nov 27 2007 0733 PM Journal Entry - Supplies bought on credit. So in this journal entry total assets on the balance sheet decrease while the total expenses on the income statement increase.

Debit Supplies and credit Accounts Payable. Company ABC purchased Office supplies costing 2500 and paid in cash. Sedlor Properties purchased office supplies on account for 800.

The accounting records will show the following purchased supplies on account journal entry. I am having trouble with this problem although I know it must be simple to answer.

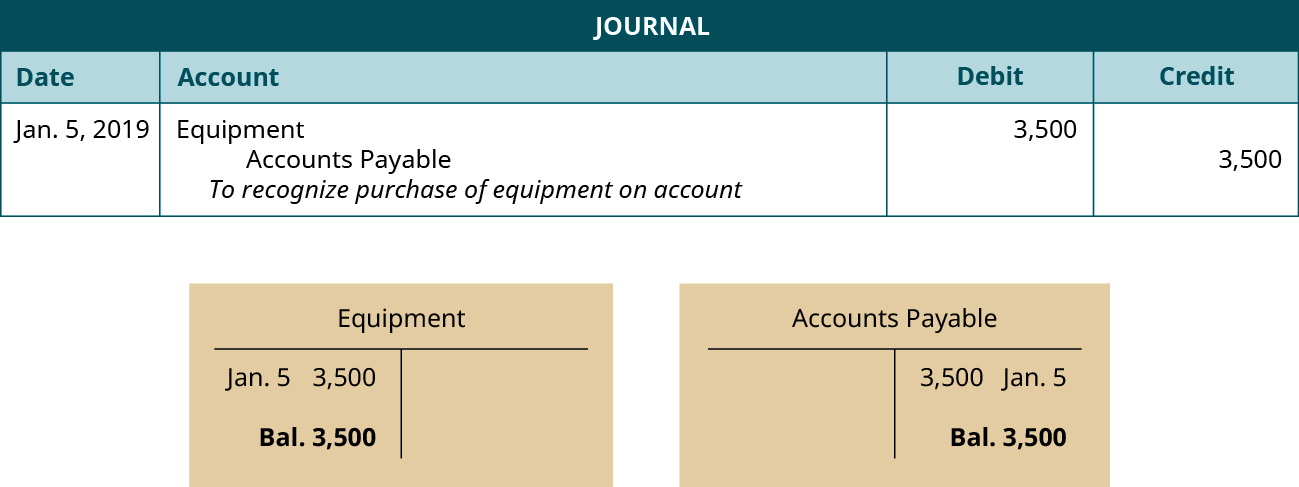

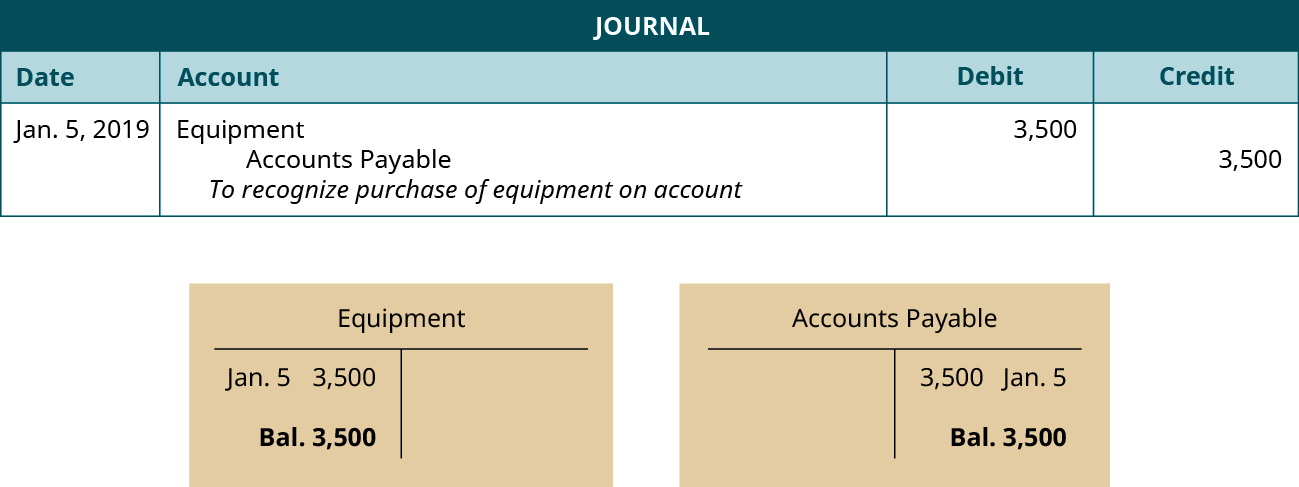

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Unit 5 The General Journal Journalizing The Recording Process Ppt Download

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Paid Cash For Supplies Double Entry Bookkeeping

Chapter Journal Review Ppt Download

Business Events Transaction Journal Entry Format My Accounting Course

Recording Purchase Of Office Supplies On Account Journal Entry

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

0 comments

Post a Comment